Crypto tax calculator australia review images are available. Crypto tax calculator australia review are a topic that is being searched for and liked by netizens today. You can Get the Crypto tax calculator australia review files here. Download all free photos and vectors.

If you’re searching for crypto tax calculator australia review pictures information linked to the crypto tax calculator australia review topic, you have come to the right blog. Our site frequently provides you with hints for viewing the maximum quality video and image content, please kindly hunt and find more informative video content and graphics that fit your interests.

For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto. Best crypto tax evaluator This has been by far the most accurate and easiest to use out of any of the other crypto tax software programs as well as crypto tracking apps Ive used. 0325 5000 1625. For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto. How is crypto tax calculated in Australia.

Crypto Tax Calculator Australia Review. They just need a crypto. How is crypto tax calculated in Australia. Best crypto tax evaluator This has been by far the most accurate and easiest to use out of any of the other crypto tax software programs as well as crypto tracking apps Ive used. Janes estimated capital gains tax on her crypto.

Electricity Consumption Calculator Electricity Consumption Electricity Calculator From pinterest.com

Electricity Consumption Calculator Electricity Consumption Electricity Calculator From pinterest.com

Best crypto tax evaluator This has been by far the most accurate and easiest to use out of any of the other crypto tax software programs as well as crypto tracking apps Ive used. The tax rate on this particular bracket is 325. For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto. Ensure the correct date range you require to calculate your crypto tax in Australia. 0325 5000 1625. Superior Customer Service I tried to use 2 other crypto tax calculators and this turned out to be a waste of time and money and a source of significant frustration because these other companies were based overseas not in Australia and their support service was not available while I was awake in Australia.

Superior Customer Service I tried to use 2 other crypto tax calculators and this turned out to be a waste of time and money and a source of significant frustration because these other companies were based overseas not in Australia and their support service was not available while I was awake in Australia.

They just need a crypto. They just need a crypto. For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto. For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included in Janes assessable income. Best crypto tax evaluator This has been by far the most accurate and easiest to use out of any of the other crypto tax software programs as well as crypto tracking apps Ive used. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your invididual circumstances.

Source: in.pinterest.com

Source: in.pinterest.com

They just need a crypto. For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included in Janes assessable income. 0325 5000 1625. Review your crypto transactions that you wish to export from your current exchange eg BTC Markets to calculate your crypto tax. For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto.

Source: sk.pinterest.com

Source: sk.pinterest.com

Superior Customer Service I tried to use 2 other crypto tax calculators and this turned out to be a waste of time and money and a source of significant frustration because these other companies were based overseas not in Australia and their support service was not available while I was awake in Australia. Ensure the correct date range you require to calculate your crypto tax in Australia. For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto. They just need a crypto. Superior Customer Service I tried to use 2 other crypto tax calculators and this turned out to be a waste of time and money and a source of significant frustration because these other companies were based overseas not in Australia and their support service was not available while I was awake in Australia.

Source: pinterest.com

Source: pinterest.com

Superior Customer Service I tried to use 2 other crypto tax calculators and this turned out to be a waste of time and money and a source of significant frustration because these other companies were based overseas not in Australia and their support service was not available while I was awake in Australia. For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included in Janes assessable income. How is crypto tax calculated in Australia. Janes estimated capital gains tax on her crypto. For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto.

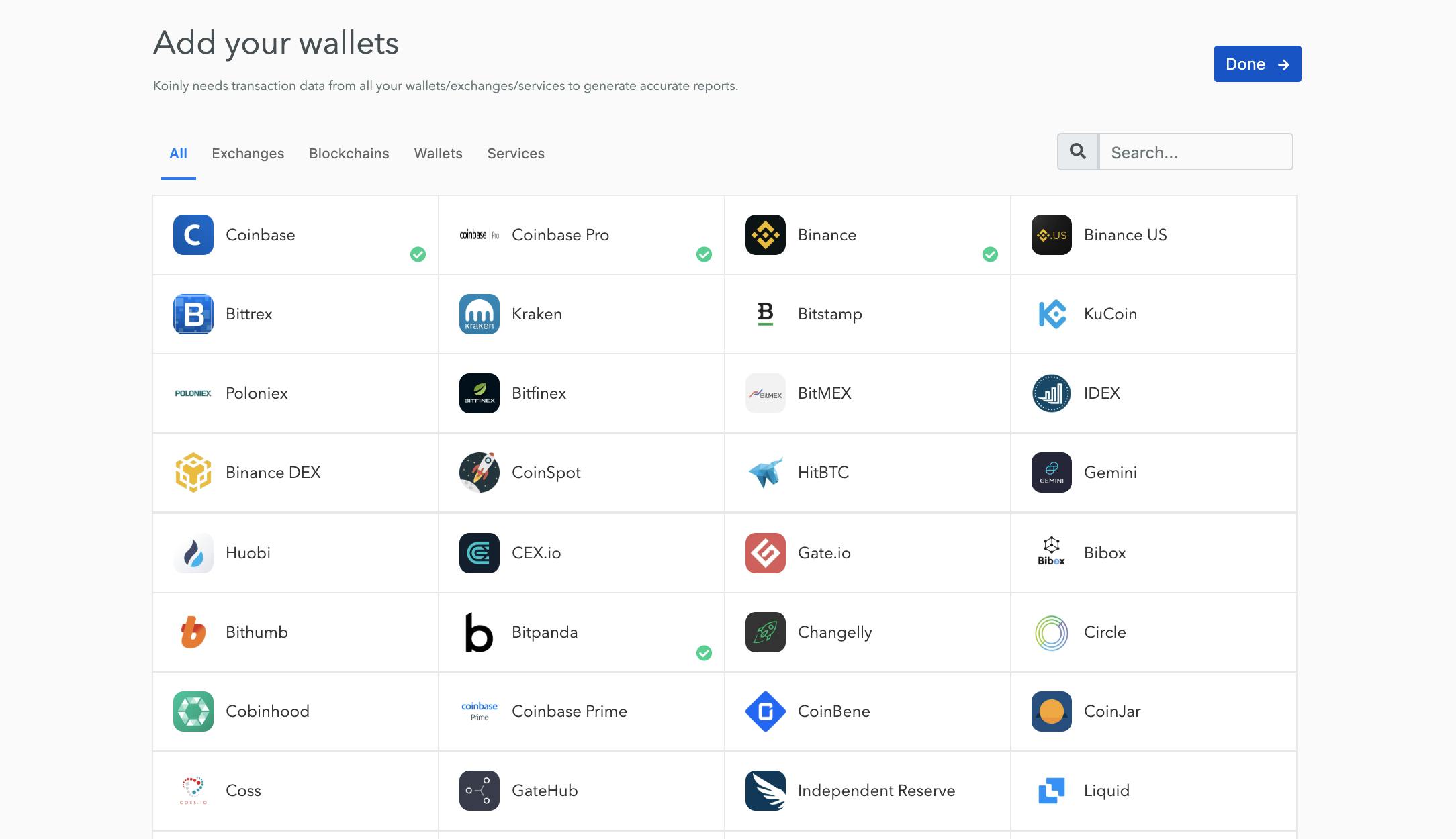

Source: koinly.io

Source: koinly.io

For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto. For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto. The tax rate on this particular bracket is 325. Review your crypto transactions that you wish to export from your current exchange eg BTC Markets to calculate your crypto tax. They just need a crypto.

Source: cryptonews.com.au

Source: cryptonews.com.au

For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included in Janes assessable income. The tax rate on this particular bracket is 325. How is crypto tax calculated in Australia. For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto. 0325 5000 1625.

Source: pinterest.com

Source: pinterest.com

Review your crypto transactions that you wish to export from your current exchange eg BTC Markets to calculate your crypto tax. 0325 5000 1625. Ensure the correct date range you require to calculate your crypto tax in Australia. Janes estimated capital gains tax on her crypto. For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included in Janes assessable income.

Source: fullstack.com.au

Source: fullstack.com.au

The tax rate on this particular bracket is 325. The tax rate on this particular bracket is 325. For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included in Janes assessable income. They just need a crypto. Review your crypto transactions that you wish to export from your current exchange eg BTC Markets to calculate your crypto tax.

Source: pinterest.com

Source: pinterest.com

0325 5000 1625. Review your crypto transactions that you wish to export from your current exchange eg BTC Markets to calculate your crypto tax. Ensure the correct date range you require to calculate your crypto tax in Australia. Best crypto tax evaluator This has been by far the most accurate and easiest to use out of any of the other crypto tax software programs as well as crypto tracking apps Ive used. They just need a crypto.

Source: cryptonews.com.au

Source: cryptonews.com.au

You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your invididual circumstances. Review your crypto transactions that you wish to export from your current exchange eg BTC Markets to calculate your crypto tax. They just need a crypto. Best crypto tax evaluator This has been by far the most accurate and easiest to use out of any of the other crypto tax software programs as well as crypto tracking apps Ive used. For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included in Janes assessable income.

Source: pinterest.com

Source: pinterest.com

0325 5000 1625. Review your crypto transactions that you wish to export from your current exchange eg BTC Markets to calculate your crypto tax. 0325 5000 1625. For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included in Janes assessable income. The tax rate on this particular bracket is 325.

Source: pinterest.com

Source: pinterest.com

For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto. Review your crypto transactions that you wish to export from your current exchange eg BTC Markets to calculate your crypto tax. The tax rate on this particular bracket is 325. 0325 5000 1625. How is crypto tax calculated in Australia.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title crypto tax calculator australia review by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.